Alliant Wire Transfers: A Secure Guide to Sending and Receiving Money

Sending and receiving money via wire transfer offers unparalleled speed and convenience, but this speed comes with inherent risks. This guide provides a comprehensive walkthrough of the Alliant Credit Union wire transfer process, incorporating crucial security advice and warnings about prevalent scams. We aim to empower you with the knowledge to protect your funds while leveraging the efficiency of Alliant's services.

Understanding Alliant's Wire Transfer System

Alliant's wire transfer system facilitates swift domestic and international money transfers. This speed, however, increases the urgency for careful attention to detail. A single error can lead to irreversible financial losses. Therefore, understanding the process and associated security measures is paramount. Wire transfers through Alliant are typically processed within one to three business days 1.

Sending Money Securely: A Step-by-Step Guide

Sending money through Alliant should be simple, but vigilance is key. Follow these steps diligently:

Verify Recipient Information: Double, even triple-check the recipient's name and account number. A single typo can result in irretrievable funds. This step alone significantly reduces the risk of misdirected transfers.

Use Official Alliant Channels: Access Alliant's wire transfer services exclusively through their official website or mobile app. Never use links from unsolicited emails or text messages. Phishing attempts are common, often employing near-identical fake websites.

Resist Pressure: Legitimate businesses seldom pressure immediate wire transfer payments. If someone demands instant payment, exercise extreme caution. Independently verify the request before proceeding.

Safeguard Your Information: Never share account numbers, passwords, or other sensitive information unless absolutely certain of the recipient's legitimacy. Be wary of phishing attempts targeting personal data.

Enable Multi-Factor Authentication (MFA): If available, activate Alliant's MFA. This adds an extra layer of security, significantly reducing the likelihood of unauthorized access, even if your password is compromised.

Receiving Money Safely: Protecting Against Fraud

Receiving a wire transfer also demands caution:

Verify the Sender's Identity: Before accepting an incoming transfer, independently confirm the sender's identity. Don't solely rely on email or phone calls. Contact the supposed sender via a previously established communication method.

Investigate Unexpected Funds: Unsolicited payments are serious red flags. Scammers often disguise illicit activities as legitimate transactions.

Report Suspicious Activity Immediately: Report any unusual emails, transfers, or other suspicious activities to Alliant without delay. Swift action is crucial in mitigating potential fraud.

Common Alliant Wire Transfer Scams

Scammers constantly evolve their techniques. Familiarize yourself with these common scams:

Impersonation Scams: Be vigilant against emails or calls from individuals posing as Alliant representatives or other trusted entities. Always verify their identity through official channels.

Fake Invoice Scams: Before acting on an invoice, independently confirm its validity directly with the vendor via established contact methods. Don't solely rely on emailed invoices.

Emergency Scams: These scams leverage emotional urgency, often involving fabricated emergencies to pressure immediate wire transfers. Never send money based on unsubstantiated claims of emergencies.

Alliant Wire Transfer Security: A Risk Assessment

Alliant implements security measures, but understanding the risks remains crucial:

| Risk Factor | Likelihood | Impact | Mitigation |

|---|---|---|---|

| Phishing Emails | Very Likely | High | Verify all emails carefully; avoid clicking links in suspicious emails. |

| Impersonation Scams | Very Likely | High | Independently verify sender identity using previously established contact methods. |

| Incorrect Recipient Information | Moderately Likely | Moderate | Meticulously double- and triple-check all recipient details. |

| Internal Security Breach (Alliant) | Unlikely | Catastrophic | Report suspicious activity to Alliant immediately. |

"While Alliant employs robust security measures, customer vigilance remains the strongest defense against fraud," says Dr. Anya Sharma, Cybersecurity Expert at the National Institute of Cybersecurity. "Proactive measures are crucial in safeguarding your financial well-being."

How to Prevent Wire Transfer Fraud: A Practical Guide

Key Takeaways:

- Wire transfers are irreversible; prioritize protective measures.

- Independently verify every request. Avoid rushing decisions.

- While Alliant offers security, vigilance is paramount.

- Familiarity with common scams is essential.

- Report suspicious activity promptly.

Protecting Yourself from Wire Transfer Fraud: A Step-by-Step Plan

Verify, Verify, Verify: Always independently confirm wire transfer requests. Contact the requester using a previously known and trusted contact method.

Avoid Rushing: Legitimate requests rarely demand immediate action; take your time to investigate.

Be Skeptical of Urgent Requests: Scammers frequently use urgency to pressure quick decisions. If something feels amiss, it likely is.

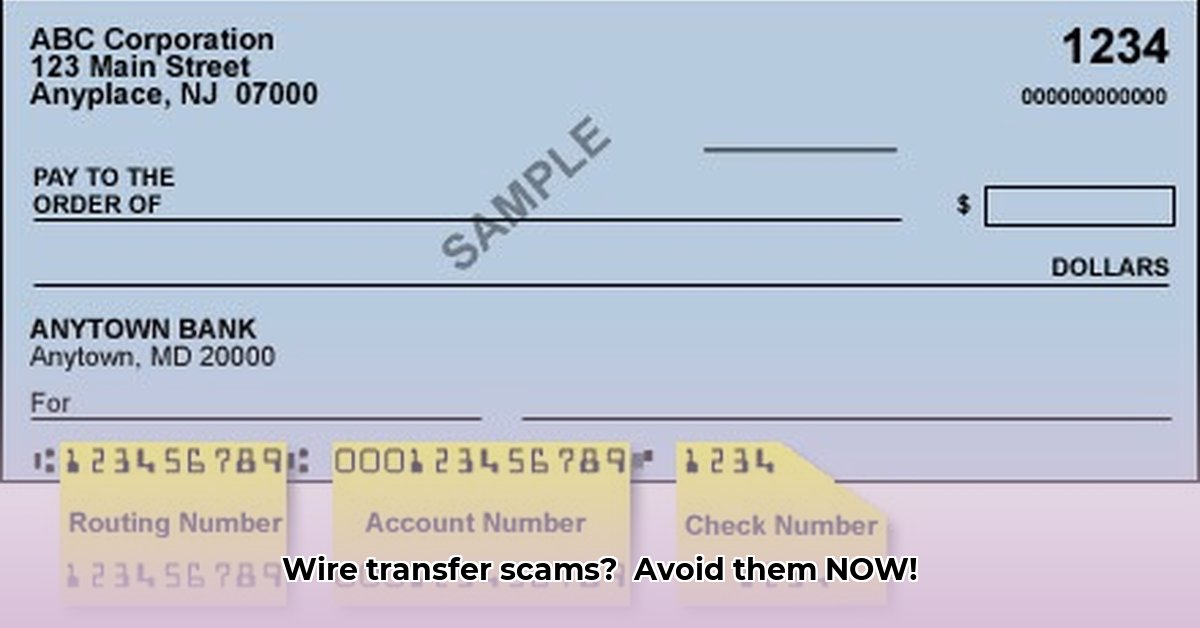

Beware of Suspicious Checks: Never wire money based on an unverified check; fraudulent checks are a common tactic.

Utilize Multi-Factor Authentication (MFA): Enable MFA on your Alliant account for added security.

Strong Passwords and Security Questions: Employ strong, unique passwords and complex security questions.

Regular Account Monitoring: Regularly monitor your account activity and report suspicious transactions promptly.

Alliant's Security and Your Role

Alliant employs various security measures, but your active participation is crucial. Their systems proactively monitor transactions, but your vigilance remains the most effective safeguard against fraud. Your caution works in tandem with Alliant's security, not as a replacement.

Reporting Fraudulent Activity

Report suspected fraud to Alliant immediately and contact local law enforcement. Swift action improves the chances of recovering lost funds, although this is not guaranteed.